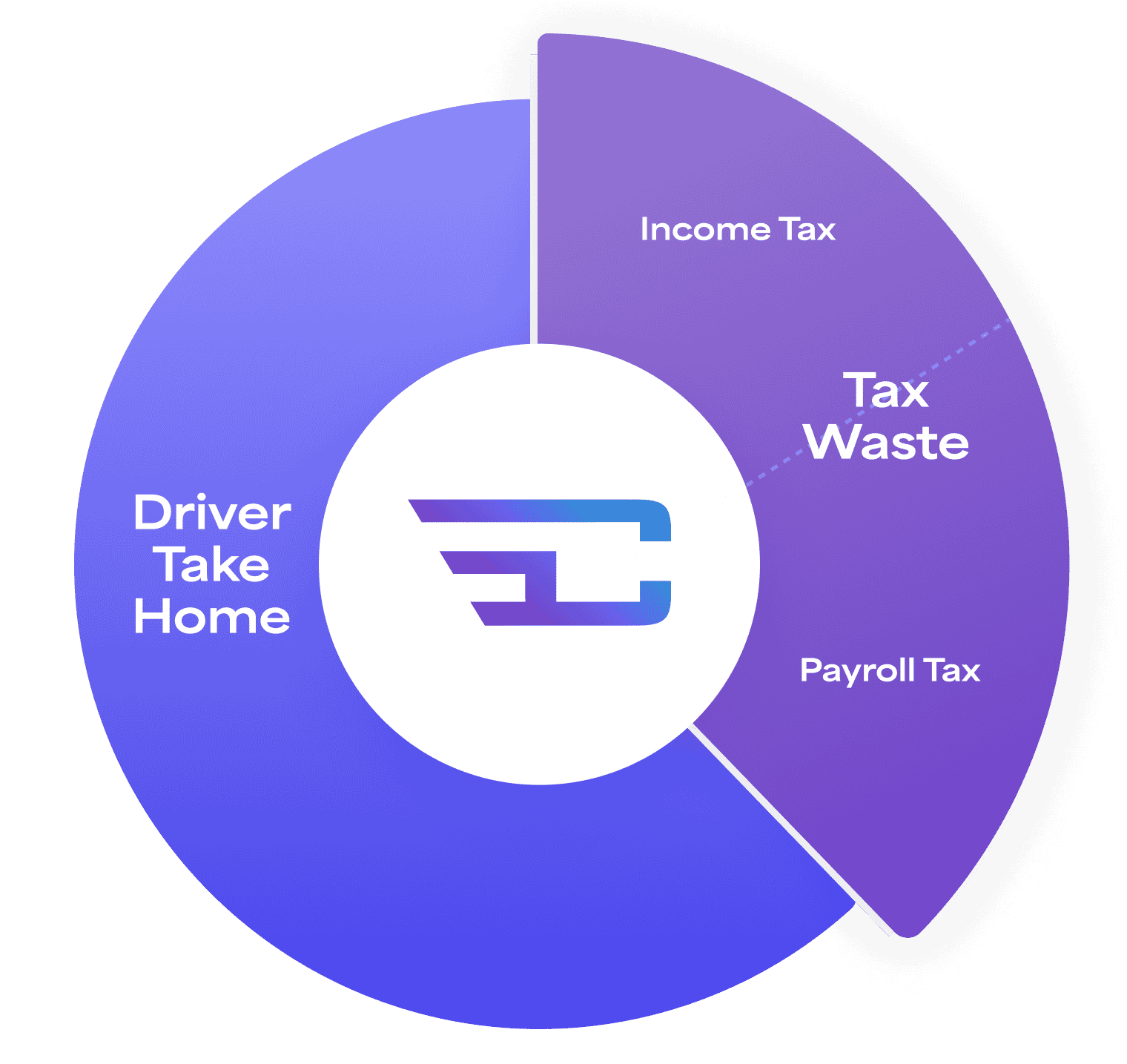

38%

of allowances are wasted on avoidable taxes

Trusted by leading brands

In-House Car Allowances Suffer From Three Things

Most in-house car allowances are taxable. They aren’t connected to real employee driving needs. Even if you’re running a tax-free allowance in-house, there are risks.

Significant unnecessary tax waste

- Seen as income by the IRS, employees are losing as much as 30%

- Employers are losing an additional 7.65% in payroll taxes

Lack of fairness or financial efficiency

- It isn’t connected to real employee driving needs

- Not geographically specific

- No mileage tracking by the driver, payments are arbitrary

Risk of tax and insurance compliance lapses

- Business mileage might not be properly logged by drivers

- You might not be ready for an audit

- Insurance and other program essentials might leave you at risk

How to Get a Tax-Free, Fair, Audit-Proof Car Allowance

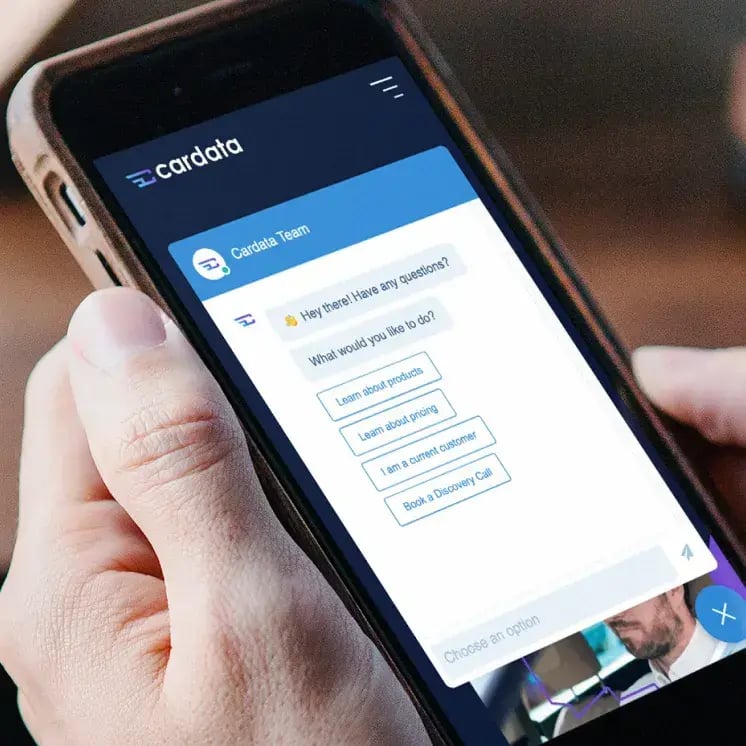

Cardata is your fully-managed, outsourced car allowance program partner.

Generate cost savings

- Save 38%* compared to taxable programs

- Strategize program spend based on goals

Mitigate risk

- Ensure 100% insurance compliance

- Reduce audit risk with mileage logs

Motivate employees

- Build driving benefits strategy on actual habits

- Get employees excited about driving for work

Why Cardata?

Cardata provides software that makes allowance tax-free, fair, and compliant. Our mileage tracking software was rated most usable in-market by G2. Plus, our software is backed by the best customer success and support in the industry.

Ease of Admin

Ease of Use

Meets Requirements

Other Factors

Cardata

Score: 9.25

Motus Vehicle

Score: 9.15

Everlance

Score: 9.11