Build for tomorrow with vehicle reimbursements

When your drivers are on the road in non-specialty construction vehicles, manage costs effectively by choosing a fully-managed tax-free fleet alternative.

Why are construction companies switching to vehicle reimbursement?

Financial monitoring

As costs of raw materials, fuel, and labor are escalating, companies are feeling the pressure to scrutinize cost inefficiencies and choose modern alternatives. Replace unmonitored fleets and unnecessary tax waste to save +30% with Cardata.

Driver benefits

Retaining skilled labor is more important than ever. Today, employees are resigning due to stagnant wages amongst the rising cost of living and a lack of competitive benefits. Construction companies are leveraging Cardata to provide fair market payments to drivers.

Software advancement

Construction leaders are turning to software to solve data gaps, enhance efficiencies and improve profitability. By increasing visibility over driver mileage and route tracking, businesses are building their intelligence and streamlining productivity. Replace idle cars and unsubstantiated payments with accountable, tax-compliant options.

The Cardata advantage

Save time and money - Powerful mobile app and cloud software that saves you weeks of manual work yearly. Paired with IRS compliant programming, Cardata helps you stay efficient and keep costs low.

Reduce corporate risk - Our built-in insurance verification, vehicle policies, and compliance oversight drastically reduce your corporate risk by holding drivers accountable when on the road for work.

Fairly capture and reimburse mileage - While Cardata’s app captures accurate mileage from your drivers, our up-to-date market data helps you build and administer fair reimbursements.

.png)

Which IRS program seems right for you?

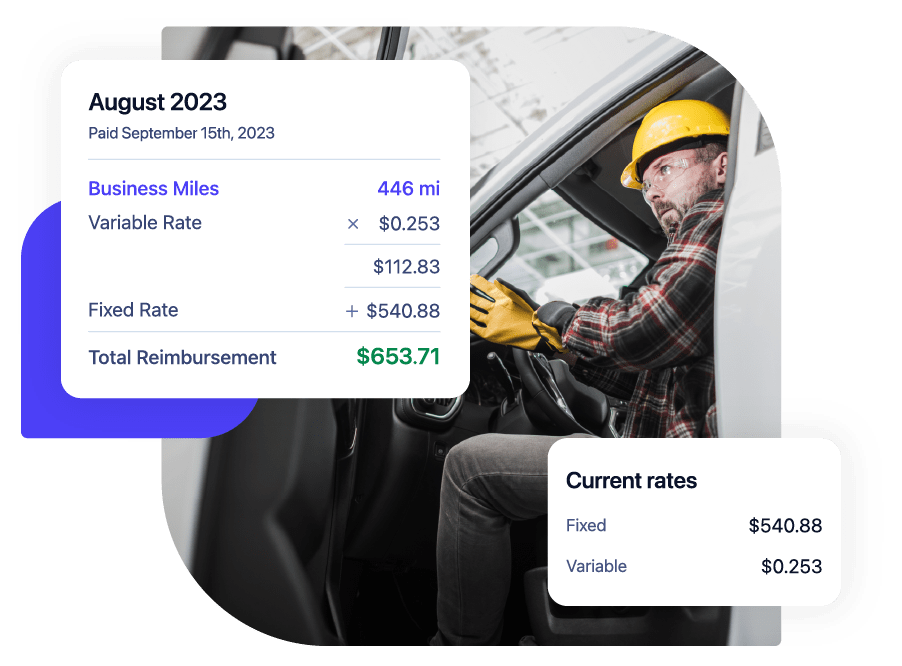

FAVR

The most popular program choice, a Fixed & Variable Rate (FAVR) program allows you to offer tax-free reimbursements to your full time drivers over the IRS standard rate.

TFCA

The Tax-Free Car Allowance program allows you to offer fair market reimbursements in a flat allowance or a fixed-and-variable format, tax-free up to the IRS standard rate.

CPM

A Cents-Per-Mile (CPM) program is great for occasional drivers. Pay on a per-mile basis using Cardata’s mobile app and service suite to reimburse your drivers with ease.

Trusted by leading brands

The engine behind Cardata

Step one

Work with a Cardata expert to design a custom and compliant vehicle program for your drivers.

Step two

Employees leverage the Cardata mobile app to accurately and effortlessly track their business trips.

Step three

Your drivers are paid equitable tax-free reimbursements. It’s that simple!What our customers are saying

“Extremely easy to use. Set it and forget it”

“The customer service was very quick with answering questions and helping me through the process”

“Easy Set Up - Prompt Communication - Accurate Records”

“The application was easy to use and when I needed assistance the team was quick to assist me on the phone.”