Vehicle Reimbursements. Simplified with Cardata.

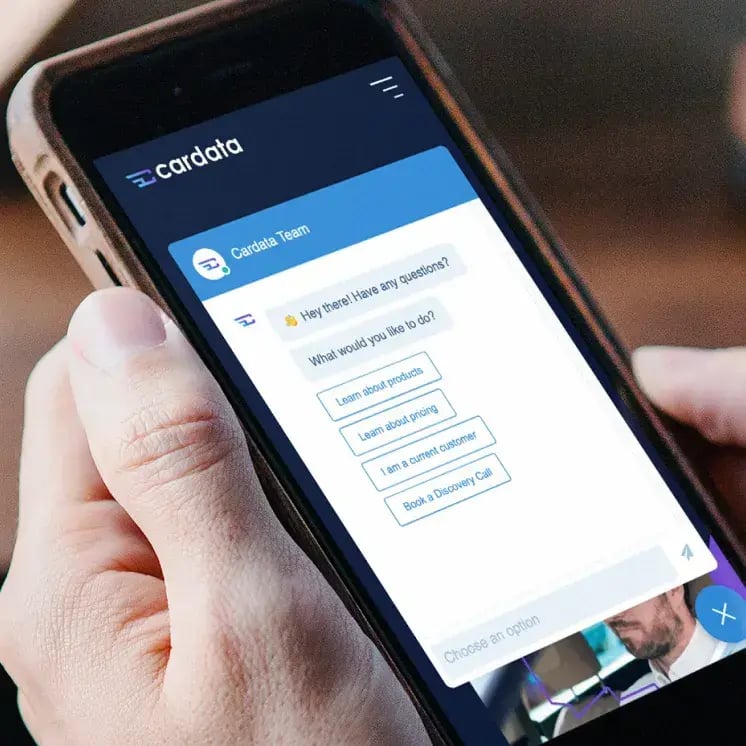

Tailor-Made for Your Business Needs

Work with a Cardata expert to design a custom and compliant vehicle program that best suits your business needs.

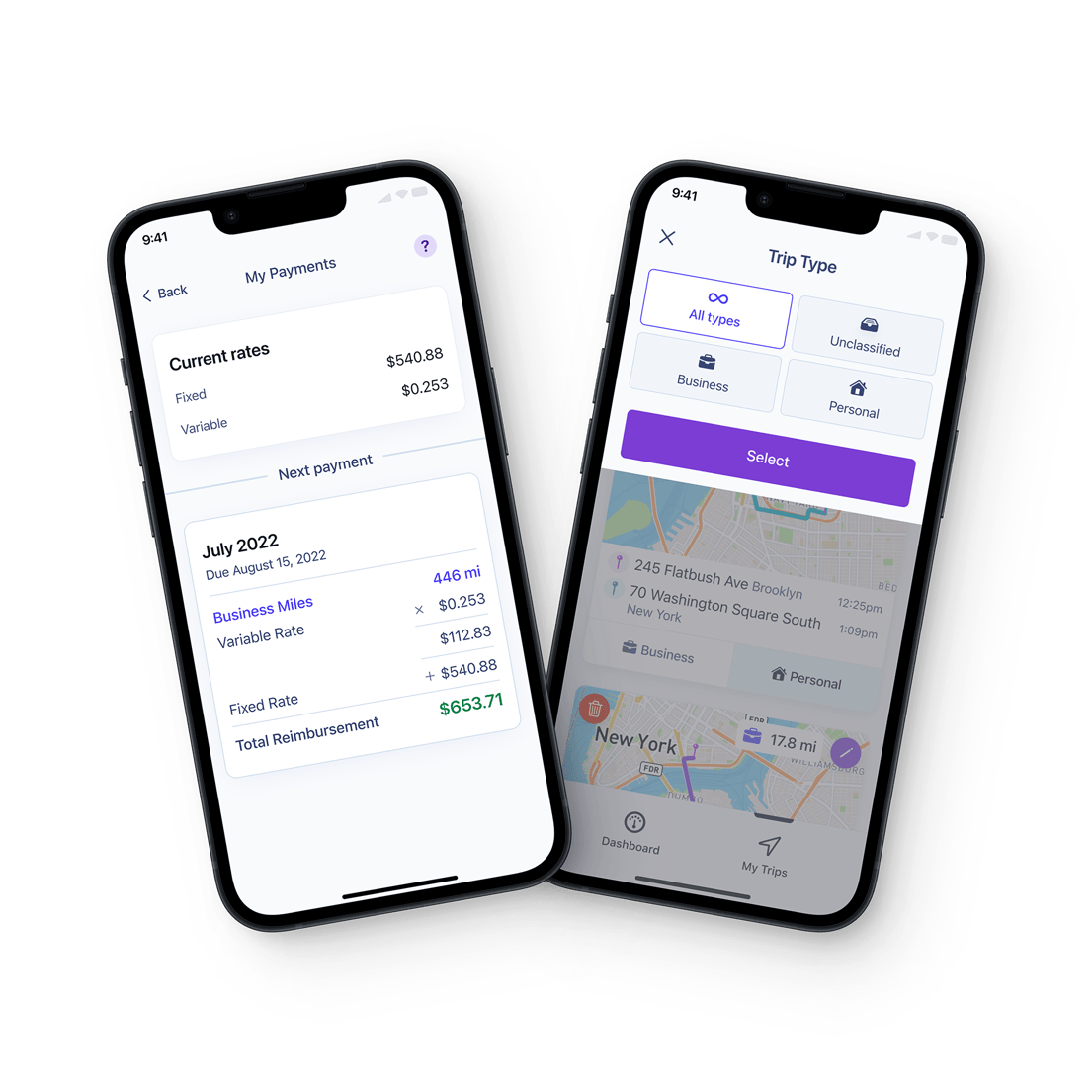

Capture Mileage Automatically

Drivers leverage the Cardata Mobile app to accurately and effortlessly track their business trips, while managers utilize Cardata’s Cloud for robust reporting.

Reimburse Your Employees Fairly

Your drivers are paid tax-free reimbursements, directly to their bank accounts.

Cardata Supports All IRS Reimbursement Programs

Fixed and Variable Rate

The most popular program choice, FAVR (fixed and variable rate) leverages market cost data to provide tax-free reimbursements to your drivers over the IRS standard rate.

Tax-Free Car Allowance

With fewer compliance requirements than FAVR, this program allows you to offer reimbursements in a simple flat allowance or a fixed-and-variable format, tax-free up to the IRS standard mileage rate.

Cents Per Mile

A cents-per-mile (CPM) program is great for occasional drivers. Pay on a per mile basis using Cardata’s mobile app and service suite to reimburse your drivers with ease.

How Cardata Stacks Up

Why Companies Choose Cardata

Save Time & Money

Powerful mobile app and cloud software that saves you weeks of manual work yearly. Paired with IRS compliant programming, Cardata helps you stay efficient and keep costs low.

Reduce Corporate Risk

Our built-in insurance verification, vehicle policies, and compliance oversight drastically reduce your corporate risk by holding drivers accountable when on the road for work.

Fairly Capture & Reimburse Mileage

While Cardata’s app captures accurate mileage from your drivers, our up-to-date market data helps you build and administer fair reimbursements.

How Cardata Stacks Up

Usability Index for Mileage Tracking

Cardata provides software that makes allowance tax-free, fair, and compliant. Our mileage tracking software was rated most usable in-market by G2. Plus, our software is backed by the best customer success and support in the industry.

The G2 index graphic ranks three vehicle program software products—Cardata, Motus Vehicle, and Everlance—using four weighted factors: Ease of Admin, Ease of Use, Meets Requirements, and Other Factors. Cardata tops the list with an overall score of 9.25, followed by Motus Vehicle at 9.15 and Everlance at 9.11.