Cardata’s Tax-Free Vehicle Allowances

Vehicle allowances can seem straightforward, but without proper compliance, they are considered income. This means taxes! Let’s change that.

Reimburse flexibly, reduce your tax, stay compliant

A tax-free car allowance (TFCA) is an IRS-compliant method of reimbursement that enables organizations to offer a fixed reimbursement component to their drivers with the potential to be 100% tax-free.

Benefits of TFCAs

- Reimburse fairly and competitively using real market data

- Limited compliance regulations, simply capture your business miles

- Build rates based on mileage estimates to avoid tax risk

- Reduce spend variability by maintaining a fixed portion to your reimbursements

Which IRS program seems right for you?

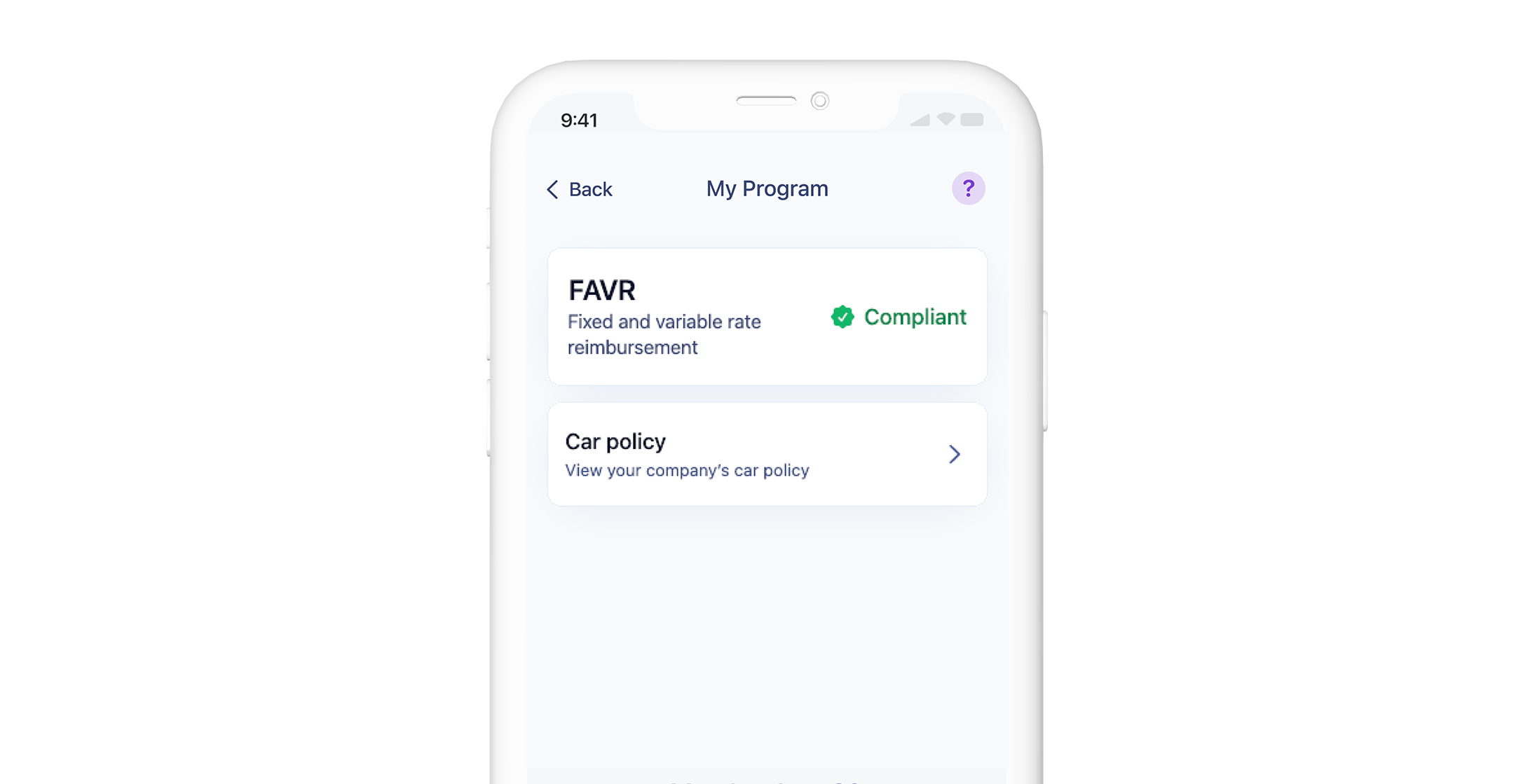

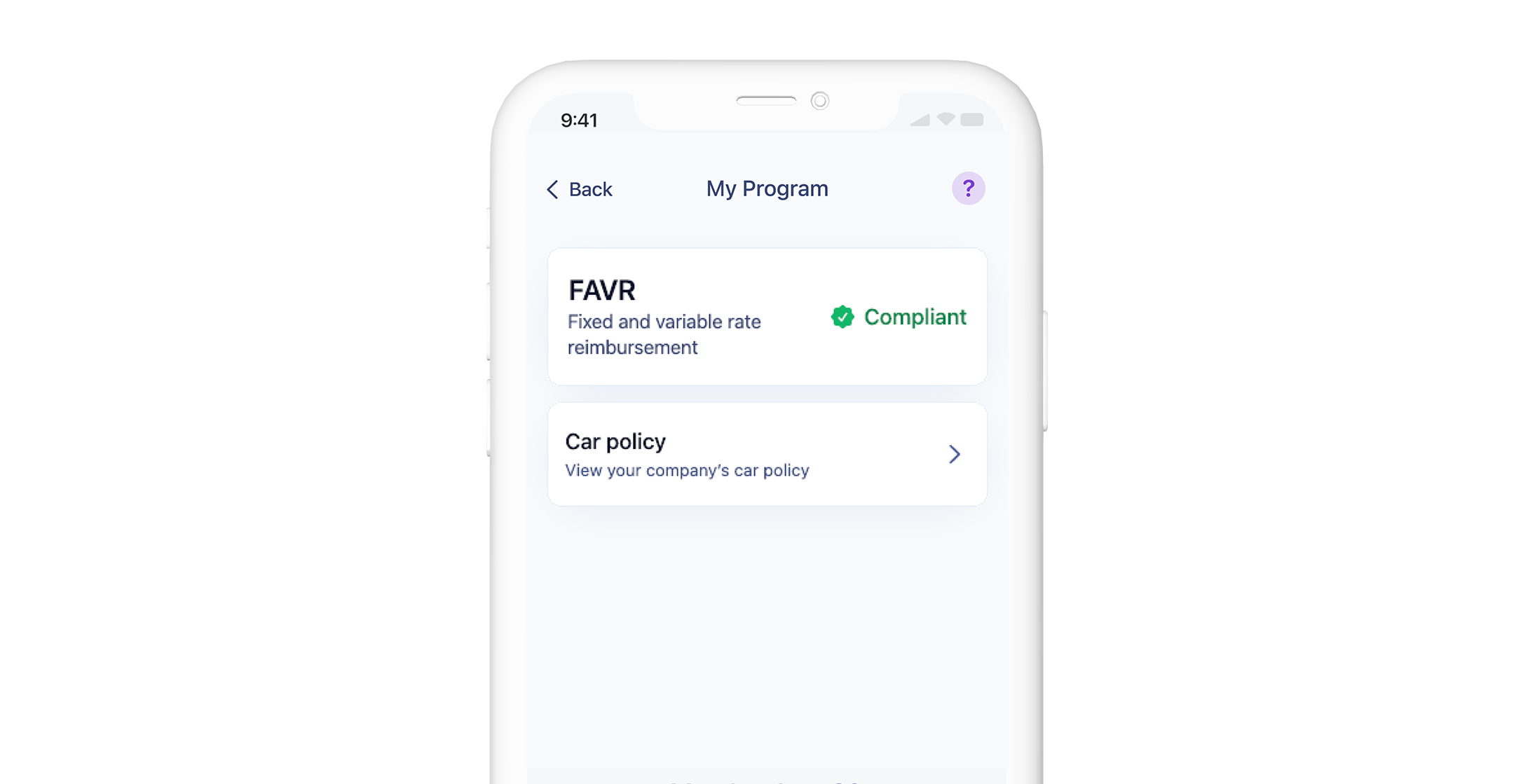

FAVR

The most popular program choice, a fixed-and-variable-rate (FAVR) program allows you to remain compliant while offering tax-free reimbursements to your drivers over the IRS standard rate.

TFCA

With fewer compliance requirements than FAVR, this program allows you to offer fair market reimbursements in a flat allowance or a fixed-and-variable format, tax-free up to the IRS standard rate.

CPM

A cents-per-mile (CPM) program is great for occasional drivers. Pay on a per-mile basis using Cardata’s mobile app and service suite to reimburse your drivers with ease.

It’s a smooth ride with Cardata’s tax-free reimbursement programs

Powerful software

Leverage powerful software

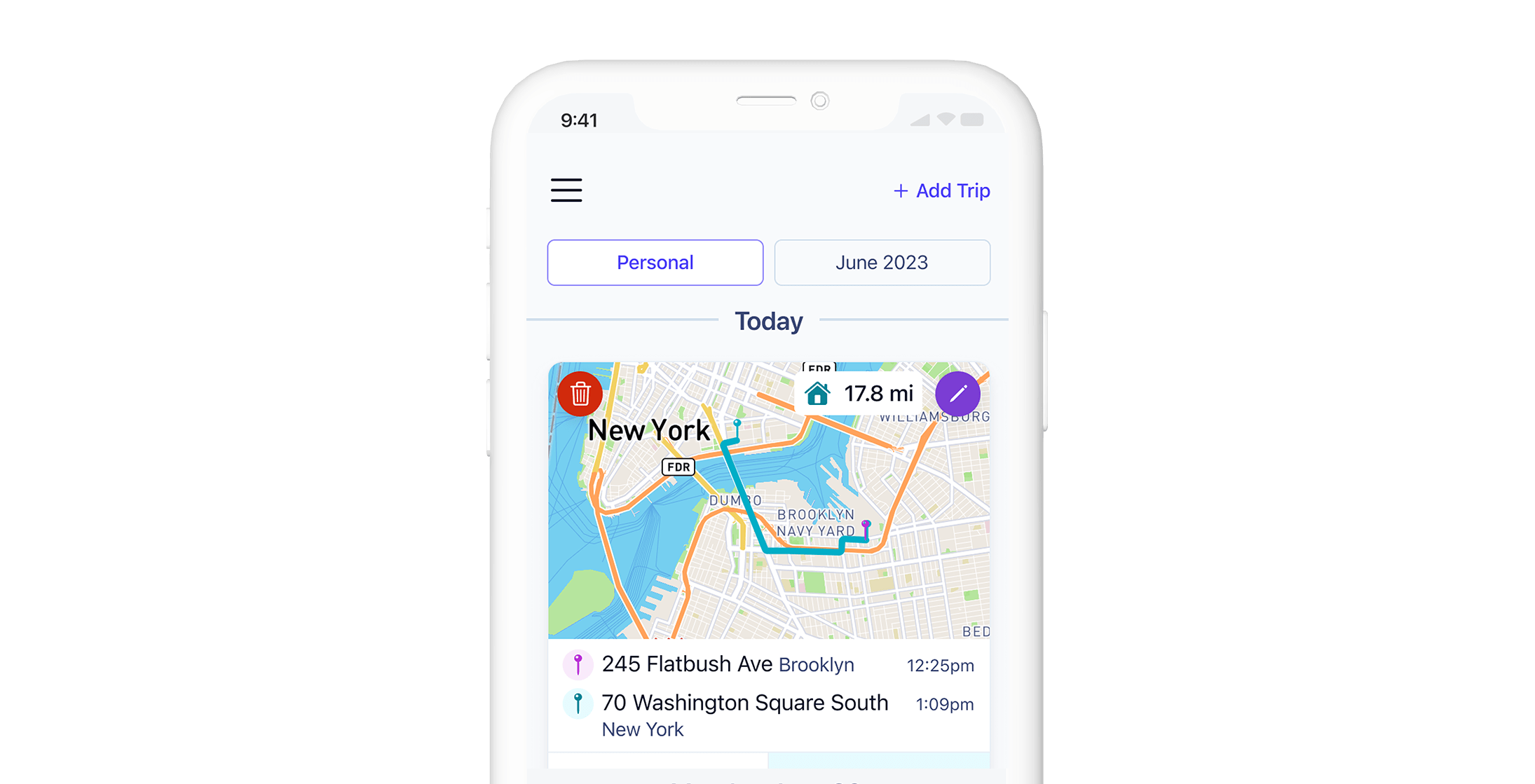

Flexible mileage tracking, direct payment processing, and cloud-based business intelligence reports will turbocharge your program. Never miss a mile with best-in-class GPS tracking software - your employees’ will thank you for accurate and fair reimbursements.

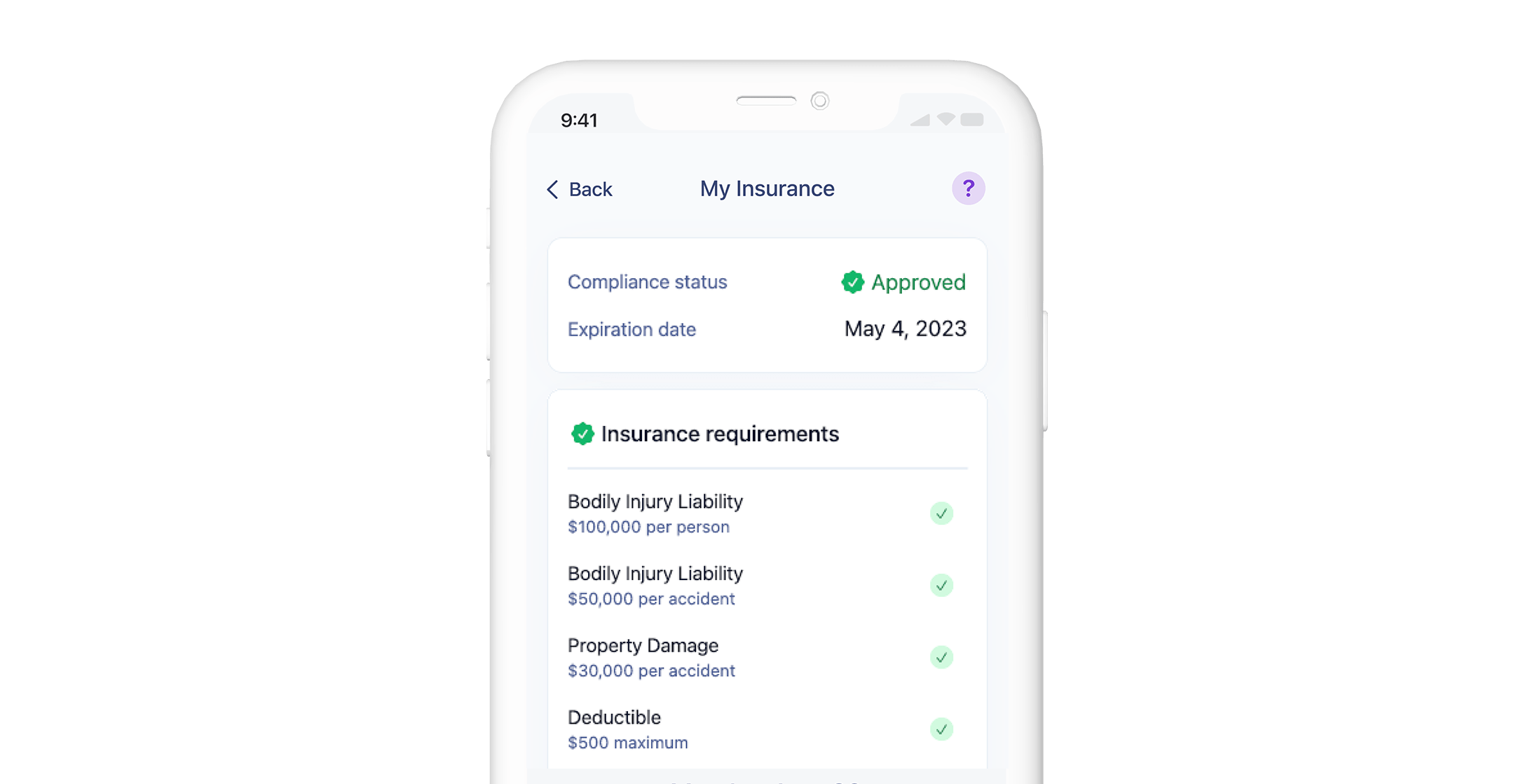

Drive compliance

Drive compliance

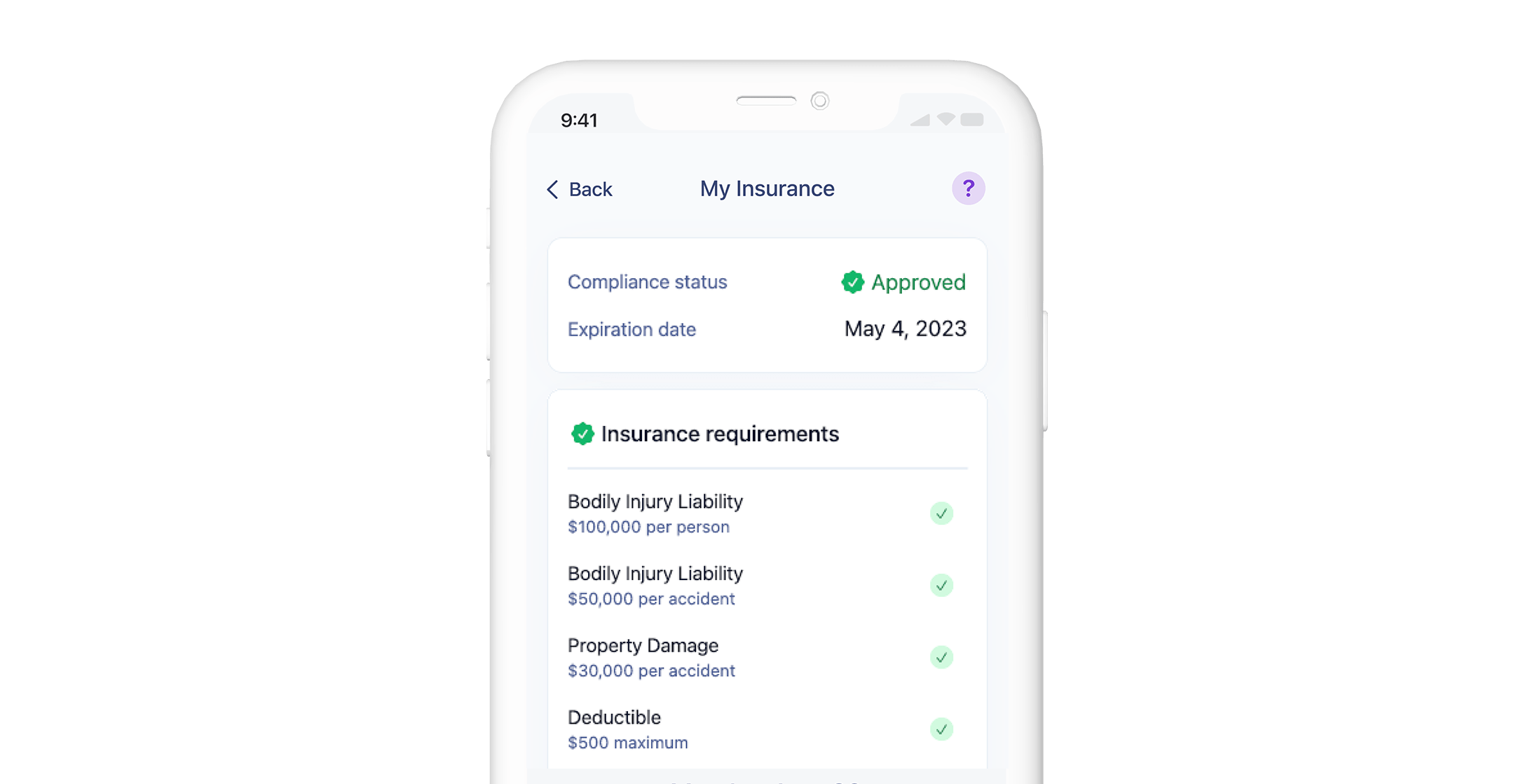

Reduce liability and promote accountability. Define your company driving policy and keep on top of employee insurance compliance with our built-in insurance verification.

Tax-efficiency

Ensure total tax-efficiency

Get the most from your vehicle program. Stay IRS-compliant, avoid tax waste, and streamline employee operations so you can save money and reinvest in business growth.

Expert support

Enjoy expert support

If you’re looking for active program management, and hands on driver support, leverage our dedicated Customer Success team and in-house support reps to help your team succeed on the road. It’s easy to see why we outrank the competition on G2 in quality of support!

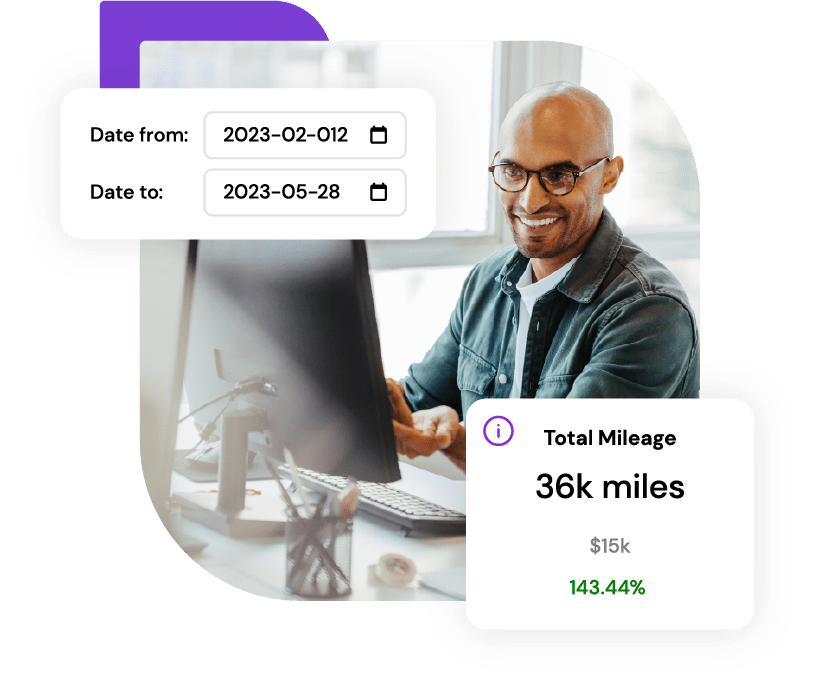

Leverage powerful software

Flexible mileage tracking, direct payment processing, and cloud-based business intelligence reports will turbocharge your program. Never miss a mile with best-in-class GPS tracking software - your employees’ will thank you for accurate and fair reimbursements.

Drive compliance

Reduce liability and promote accountability. Define your company driving policy and keep on top of employee insurance compliance with our built-in insurance verification.

Ensure total tax-efficiency

Get the most from your vehicle program. Stay IRS-compliant, avoid tax waste, and streamline employee operations so you can save money and reinvest in business growth.

Enjoy expert support

If you’re looking for active program management, and hands on driver support, leverage our dedicated Customer Success team and in-house support reps to help your team succeed on the road. It’s easy to see why we outrank the competition on G2 in quality of support!

The engine behind a TFCA program

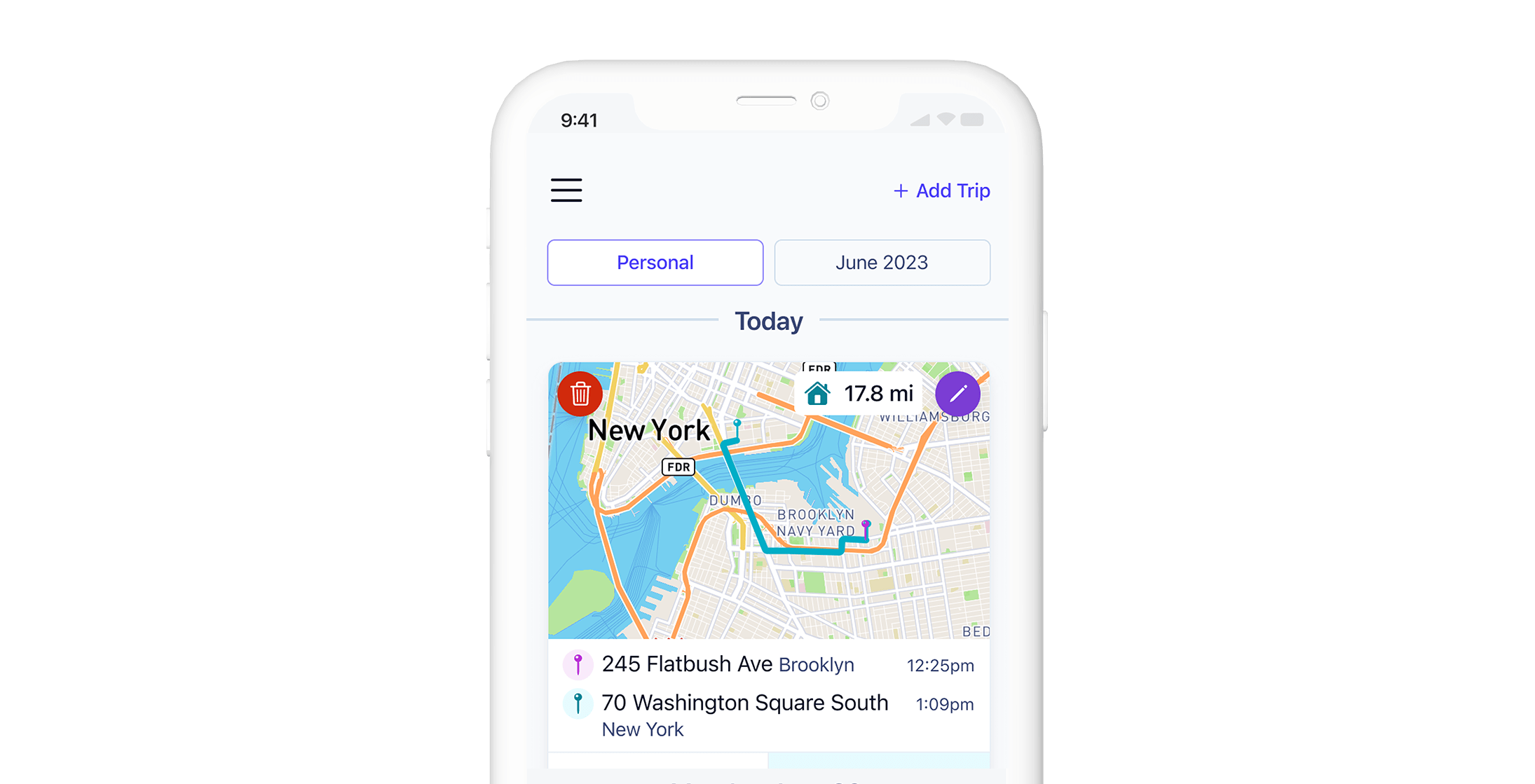

Step One

Employees leverage the Cardata mobile app to accurately and effortlessly track their business trips.

Step Two

Cardata compares your drivers reimbursements to the IRS standard rate. If drivers receive more than the IRS rate, only the difference is taxable.

Step Three

Your drivers get fast and fair reimbursements. It’s that simple!Trusted by leading brands

What our customers are saying

“Extremely easy to use. Set it and forget it”

“The customer service was very quick with answering questions and helping me through the process”

“Easy Set Up - Prompt Communication - Accurate Records”

“The application was easy to use and when I needed assistance the team was quick to assist me on the phone.”

Let’s create your ideal solution together.

Ready to transform your vehicle program with Cardata?